The Best Strategy To Use For Offshore Business Formation

Table of ContentsThe Greatest Guide To Offshore Business Formation9 Simple Techniques For Offshore Business FormationUnknown Facts About Offshore Business FormationA Biased View of Offshore Business FormationA Biased View of Offshore Business FormationOffshore Business Formation for Dummies

Usually talking, the Disadvantages will differ in a case-by-case circumstance. The country where the company is signed up will enforce company earnings tax obligation on its worldwide earnings. Additionally, the company will certainly be required to report its globally earnings on its home country's tax return. The process of establishing up an offshore business is much more complex than developing a normal firm.

Establishing an overseas firm doesn't give any type of savings considering that you still pay tax obligation on your worldwide earnings. If you want to reduce your worldwide tax obligation worry, you should take into consideration developing numerous firms as opposed to one overseas entity. When you relocate money out of an offshore location, you will certainly be responsible for that income in your house country.

10 Simple Techniques For Offshore Business Formation

The compromise is that overseas companies incur costs, costs, and also various other disadvantages. If you prepare to incorporate offshore, after that you must recognize regarding the pros as well as disadvantages of incorporating offshore. Every area and jurisdiction is different, and also it's challenging to really recognize truth effectiveness of an overseas firm for your service.

If you have an interest in evaluating Hong Kong as an option, call us for more details as well as one of our experts will certainly walk you via Hong Kong as an offshore unification option (offshore business formation).

Discover the advantages and disadvantages of establishing an offshore business, including privacy as well as decreased tax liability, as well as discover exactly how to sign up, develop, or incorporate your service beyond your country of home. In this short article: Offshore business are organizations registered, developed, or incorporated beyond the nation of house.

The Definitive Guide to Offshore Business Formation

If a legal challenger is going after legal activity against you, it typically includes a property search. This makes sure there is cash for payments in the event of a negative judgment versus you. Forming overseas firms and also having possessions held by the abroad firm indicate there is no longer a link with your name.

A fringe benefit is simplicity as well as ease of procedure. A lot of overseas jurisdictions make it straightforward for anyone to integrate. The legal commitments in the operating of the overseas entity have actually likewise been streamlined (offshore business formation). Due to the absence of public signs up, proving possession of a firm registered offshore can be challenging.

One of the primary drawbacks is in the area of compensation and also distribution of the assets and revenue of the overseas company. Once cash reach the resident nation, they are subject to taxes. This can negate the advantages of the first tax-free pop over to these guys setting. Returns revenue received by a Belgian holding business from a company based somewhere else (where earnings from foreign resources is not taxed) will certainly pay corporate income tax at the typical Belgian rate.

All about Offshore Business Formation

In Spain, holding back tax obligation of 21% is payable on interest as well as dividend repayments, whether residential or to non-treaty nations. However, where rewards are paid to a company that has share funding that has been held during the previous year equal to or over 5% holding back tax does not apply. This means that tax obligation is deducted prior to cash can be paid or moved to an overseas firm.

The main drive of the regulation is in requiring such companies to demonstrate past a practical doubt that their underlying activities are genuinely executed in their corresponding overseas center which these are without a doubt typical business tasks. There are large tax obligation dangers with providing non-Swiss firms from exterior of Switzerland.

A further factor to consider is that of reputational risk - offshore business formation.

Examine This Report about Offshore Business Formation

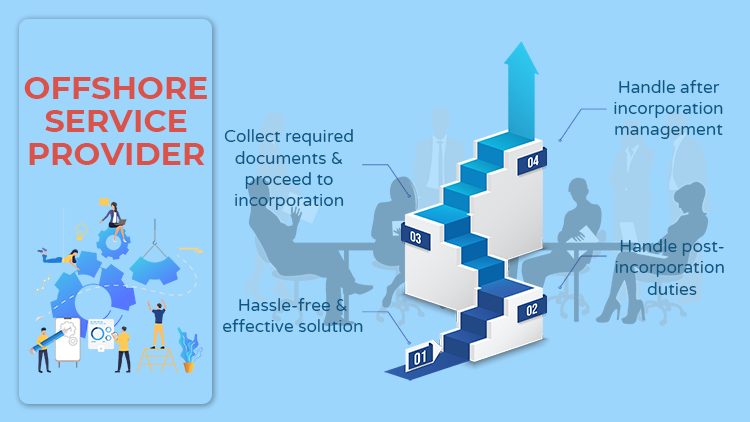

The offshore business enrollment procedure should be embarked on in total supervision of a company like us. The need of going for offshore firm enrollment process is required prior to establishing a firm. As it is needed to fulfill all the conditions after that one have to refer to a proper anchor organization.

Benefit from no tax obligations, bookkeeping as well as auditing, and a totally transparent, low financial investment venture. When choosing a procedure that needs correct interest while the satisfaction of rules and also policies then it is needed to follow particular steps like the services offered in Offshore Firm Formation. For even more details, check out here please full our and also a representative will certainly be in contact in due training course.

India, China, the Philippines, Poland, Hungary, Ukraine, Brazil, Argentina, Egypt, and also South Africa are a few of the finest countries for offshore growth.

The Main Principles Of Offshore Business Formation

There are many factors why entrepreneurs might be interested in establishing up an offshore company: Tax obligation benefits, reduced compliance expenses, a helpful banking environment, as well as new profession chances are some of one of the most frequently mentioned reasons for doing so. Here we look at what business owners need to do if they desire to establish a Hong Kong overseas firm (offshore business formation).

This is because: There is no need for the firm to have Hong Kong resident supervisors (a common need in various other nations) as Hong Kong embraces a policy that prefers offshore business established by foreign financiers. offshore business formation. There is no requirement for the firm to have Hong Kong resident investors either (a common requirement elsewhere) international entrepreneurs do not require to companion with a local homeowner to refine a Hong Kong business configuration.